Climate Risk Real Estate Values in the U.S.

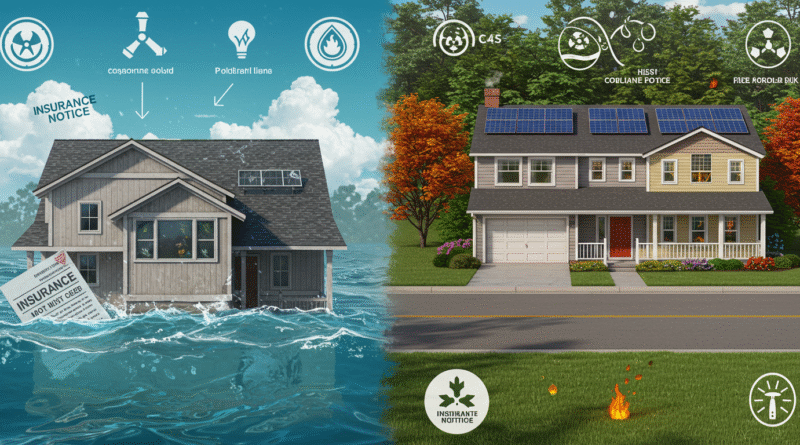

Climate risk real estate values are emerging as a seismic shift in the U.S. property landscape. A comprehensive new study shows that climate change could eradicate up to $1.5 trillion in home equity—fueled by rising insurance costs, buyer avoidance, and increasingly severe weather events.

Climate risk real estate values: Insurance Costs Drive Home Losses

As climate threats intensify across the United States, homeowners in vulnerable areas are facing an escalating insurance crisis that’s reshaping the real estate landscape. From California’s wildfire-prone regions to Florida’s hurricane-battered coastlines and the low-lying bayous of Louisiana, insurance premiums are skyrocketing; often rising between 30% to 70% annually.

But the crisis doesn’t stop there.

In Texas, severe storms and rising flood risks have driven up both insurance costs and underwriting scrutiny. Meanwhile, New York and New Jersey; particularly coastal and riverfront neighborhoods, are facing increased floodplain designations. These have translated to higher premiums and stricter building requirements. Even inland areas like parts of Colorado are experiencing pressures from worsening droughts and wildfires. All these end up putting unexpected strain on homeowners and the broader real estate market.

Moreover, these rising costs and tightening restrictions are disproportionately affecting middle- and lower-income homeowners, many of whom cannot afford the compounding costs of insurance, property upkeep, and climate resilience upgrades. This trend is not only reshaping where Americans choose to live; but also who can afford to stay.

The Climate Change Saga Continues

Buyers Are Pulling Back

Weather-anxious consumers are already reshaping demand. Analysts suggest that purchases in vulnerable markets are down by 15–20%, while interior regions are seeing modest price growth.

Buyers are growing cautious, and in many cases, are steering clear of properties located in climate-vulnerable regions. This shift in sentiment is cooling formerly hot markets, reducing demand, and flattening property values. Homes that were once considered prime real estate are now lingering on the market; especially those in areas with known risks and no clear mitigation plans.

As climate awareness grows among millennials and Gen Z, homes are being chosen based on resilience as much as location or style.

Climate risk real estate values: The Case for Resilient Development

This looming crisis isn’t just a homeowner problem; it affects banks, insurers, and local governments. Without intervention, default rates could climb dramatically as policy costs outpace incomes.

But there’s a silver lining: climate-smart design, including elevated foundations, fire-resistant materials, green infrastructure, and solar systems. These can stabilize values and attract climate-conscious buyers.

Conclusively, the era of unchecked property appreciation in risky areas is ending. These risk values demand a market reset; prioritizing resilience, transparency, and adaptive strategies.

We must ask: will homeowners, developers, insurers, and policymakers unite to safeguard communities; or let climate drift dismantle home equity?