ESG Real Estate Trends to Watch in 2025

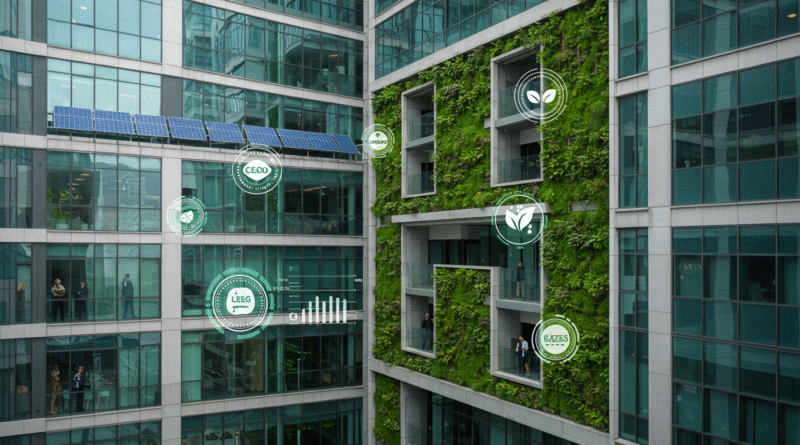

ESG commercial real estate 2025 is no longer a buzzword—it’s the new benchmark for property development and investment worldwide. As climate concerns mount and regulatory pressures tighten, developers and institutional investors are leaning heavily into Environmental, Social, and Governance (ESG) strategies to future-proof assets and unlock long-term value.

ESG Real Estate Trends: Why It Matters

ESG frameworks have become essential in evaluating real estate portfolios. In 2025, green-certified properties like LEED, BREEAM, and EDGE have become hot commodities; not just for their environmental credentials, but also because they outperform traditional buildings on long-term ROI, tenant retention, and compliance risk not to mention their ‘green earth’ benefits.

Commercial real estate firms are now facing mounting pressure from both investors and regulators to reduce carbon footprints and demonstrate social responsibility. In cities across Europe, North America, and increasingly Africa, carbon disclosure regulations are tightening, forcing developers to adopt climate-smart construction, renewable energy systems, and low-emission materials.

What ESG Means for Property Values and Investment Flows

The impact of ESG real estate trends in 2025 extends far beyond energy audits or rooftop solar. Sustainable buildings enjoy higher occupancy rates, better financing terms, and growing asset premiums in global markets. For example:

- Pension funds and REITs are redirecting capital to green-certified portfolios.

- Banks and lenders are now offering discounted interest rates for certified sustainable buildings.

- Tenants, especially corporates, are prioritizing ESG-aligned workspaces to meet their own sustainability goals.

In Africa, we’re seeing pioneering projects in Kigali, Accra, Nairobi, and Lagos begin to adopt ESG principles. While the continent faces infrastructure challenges, the potential for green real estate is vast; especially when backed by regulatory incentives and international climate financing.

The Future of ESG in African Real Estate

As African cities urbanize rapidly, ESG offers a path to sustainable and inclusive growth. The challenge? Bridging the funding gap for low-carbon infrastructure while aligning local building codes with global ESG standards. Governments, developers, and civil society must work together to build properties that are climate-resilient, socially inclusive, and transparently managed.

The path forward is clear: ESG isn’t just a trend; it’s a requirement for relevance in today’s evolving real estate landscape.

In other news, diplomatic buildings in Abuja are now under the spotlight as 34 embassies face possible closure for owing ground rent; some for over a decade. Yes, you read that right. Read full story here