How Climate Change Is Reshaping Real Estate Value in the U.S.

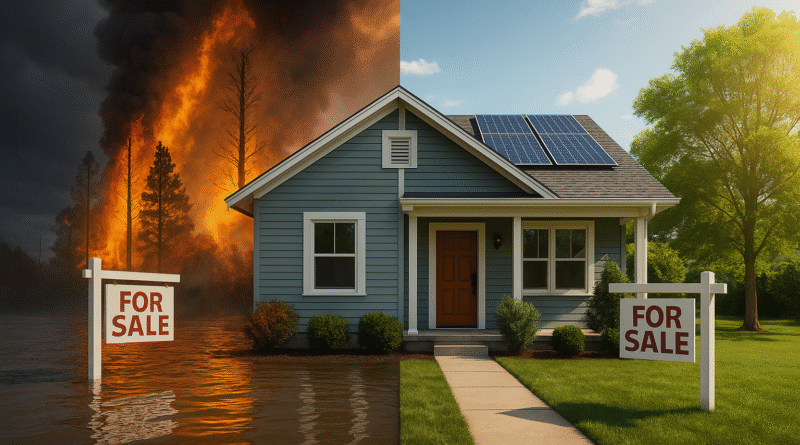

As climate change intensifies, it’s not just polar ice caps and weather patterns being affected—the U.S. real estate market is now staring down a staggering $1.47 trillion in potential losses, and homeowners in high-risk zones are feeling the heat.

When Jennifer, a longtime Florida resident, tried to renew her home insurance policy this year, she was hit with a 300% increase in premiums. Her waterfront home, once seen as a retirement dream, had now become a liability. “I couldn’t believe it. I’m being penalized for the very view I worked my whole life to enjoy,” she said.

Jennifer’s story isn’t unique. Across the U.S., homeowners in flood-prone and wildfire-prone regions are facing skyrocketing insurance premiums, depleting property values, and a growing reluctance from buyers to invest in climate-vulnerable areas.

According to a recent report by New Silver, climate change could slash $1.47 trillion from the U.S. real estate market. Thus, this looming crisis stems largely from increased insurance costs and evolving buyer behaviors. With disasters becoming more frequent and severe, the market is seeing a significant shift.

The market is steering clear of risky areas and toward sustainable, resilient alternatives.

Climate Risk Real Estate: What’s Driving the Real Estate Decline?

Soaring Insurance Premiums: As risks mount, insurers are charging more—or pulling out altogether.

Shifting Buyer Preferences: Millennials and Gen Z—the now key real estate players, are prioritizing safety and sustainability over aesthetics or location—a true shocker.

Climate Disclosures: Some states now mandate that sellers disclose climate risks, which can drive down demand and value.

But! There’s a silver lining;

Green Real Estate is Booming!

Properties that incorporate renewable energy, water conservation systems, and climate-resilient designs are commanding higher prices and selling faster. Consequently, the Investors and developers who embrace eco-conscious strategies are not just future-proofing their assets—they’re tapping into a rapidly growing market.

Furthermore, as climate risk becomes central to real estate valuation, the industry must evolve. Green building codes, smarter infrastructure, and transparent climate data will no longer be optional—they’ll be essential.

The question is no longer “Can we afford to build green?” It’s “Can we afford not to?” given the prevalent circumstances.

Check out Our Previous release HERE