Why Green Buildings Are the Next Big Money in African Real Estate

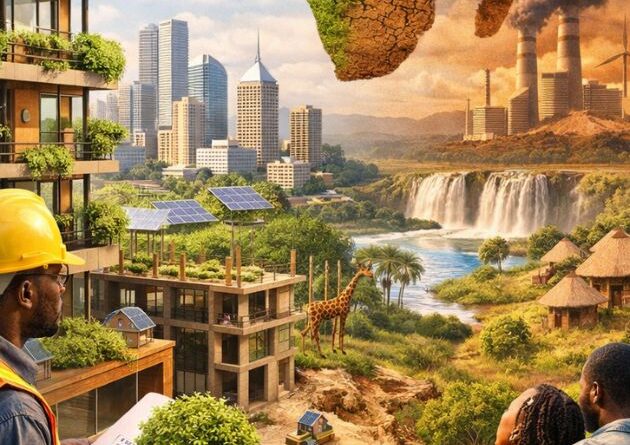

Nigeria’s real estate market is changing. Climate risks, rising energy costs, and investor pressure now shape how properties gain value.

Around the world, developers who build green earn more, pay less in taxes, in operation, and attract better tenants. The same opportunity now exists in Nigeria. Sustainable real estate no longer sits in the future, it already creates the next wave of profit across Africa.

What is Sustainable Real Estate?

Sustainable real estate means building and managing properties that use energy and water wisely, reduce pollution, and stay strong against climate damage.

It includes solar power, efficient cooling, smart design, and materials that lower carbon emissions. According to global real estate trends, buildings that follow these standards attract more tenants, command higher rents, and qualify for green financing and tax incentives. Therefore, sustainability is no longer just about the planet, it is about money.

Nigeria, with its growing cities and housing demand, sits in the perfect position to benefit.

Where Nigeria Is Losing Money Today

Most buildings in Nigeria still depend on diesel generators, poor insulation, and inefficient design. As a result, owners pay high fuel costs, tenants face rising service charges, and properties lose value faster.

In addition, weak building regulations allow developers to ignore energy standards. Many new estates go up without solar, rainwater harvesting, or natural ventilation. This increases operating costs and makes properties less attractive to international investors who now prioritize sustainability.

Climate change also worsens the problem. Floods, heat waves, and erosion continue to damage properties. Because these buildings were not designed to handle extreme weather, owners pay more for repairs and insurance. Over time, this reduces profitability.

So, Nigeria is not just breaking climate rules, It is losing money because of it.

How Green Buildings Turn Climate Risk into Profit

Green buildings flip this problem into an opportunity.

First, energy-efficient buildings reduce power bills by using solar panels, better insulation, and smart lighting. In a country where electricity is unreliable, this alone gives green buildings a huge financial edge.

Second, green properties attract better tenants. Multinational companies, banks, and high-income renters now prefer sustainable spaces because they cut operating costs and support Environmental, Social and Governance (ESG) goals. Therefore, landlords can charge higher rents and enjoy lower vacancy rates.

Third, green buildings qualify for special funding. Nigerian developers can access green bonds, climate finance, and international investor funds when they build sustainably. These financing options reduce borrowing costs and increase project margins.

In other words, green buildings cost more upfront, but they earn more over time.

PwC’s global sustainability Survey

Nigeria’s Real Estate Boom: Big Q3 Gains, Tougher Questions Ahead

Why Nigeria Is Africa’s Best Green Property Bet

Nigeria has one of Africa’s fastest-growing populations and the largest urban housing demand. This creates huge pressure to build and build fast. However, this also creates a rare chance to build right.

If developers switch to sustainable designs now, they can lock in lower energy costs, higher property values, and long-term investor interest.

At the same time, the government can support this shift by enforcing green building codes, offering tax breaks, and promoting solar-powered estates.

Conclusion

When Nigeria aligns real estate growth with climate-smart design, it will not only protect the environment, it will unlock billions in new property value. Green buildings are not a trend in Africa especially in Nigeria, they are the next big money.